wealthfront vs betterment tax loss harvesting

However this restriction was removed years ago. Robo Advisor Wealthfront Review.

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

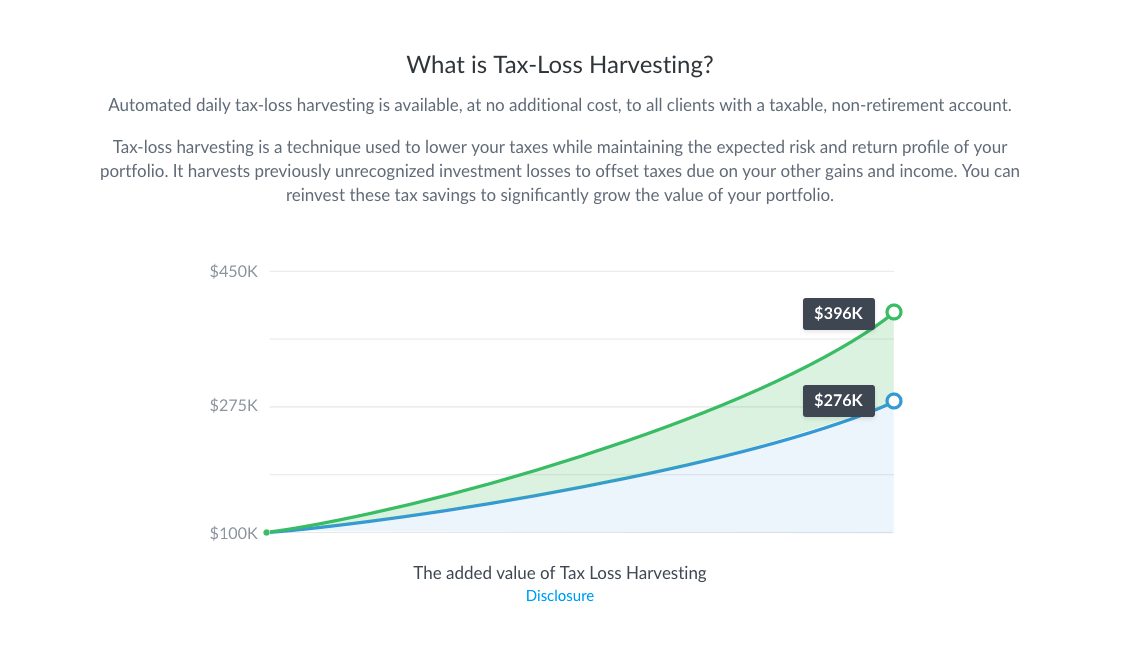

Tax-loss harvesting is the process of writing off the losses on your investments in order to claim a tax deduction against your ordinary income.

. I hope Ive made the benefits clear and the process approachable. These withdrawals are usually in the form of payroll-deducted pre-tax contributions. You gain access.

Between 10 and 37. But luckily you can minimize your tax bite by selling off assets that have experienced a loss and replacing them with others. Prices are up-to-date as of January 24 2020.

But if you start working remotely full-time across state lines you may have to file and pay tax in two states. Selling profitable investments can trigger the capital gains tax either short- or long-term. For more tips on effective and simple tax loss harvesting please read my Top 5 Tax Loss Harvesting Tips.

Like Betterment they allow you to automatically invest in various verticals but the brokerage also allows you to trade both stocks and ETFs for free. One of the tools I recommend to beginners and advanced investors is. Tax-minimization strategies and tax-loss harvesting.

Balanced Stock Portfolio with M1 Finance. Federal Income Tax Brackets. Maximize your tax benefits through.

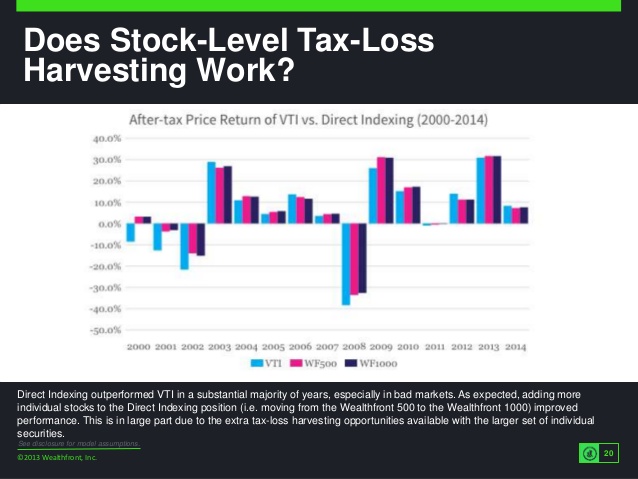

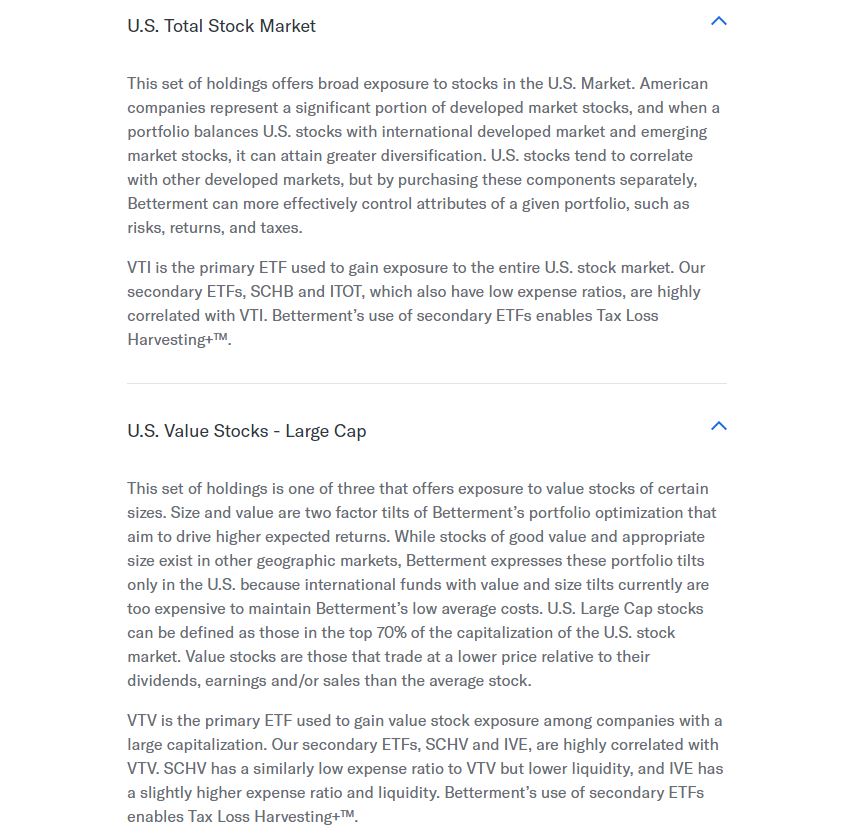

M1 Finance has brought a great new perspective to investing. Wealthfronts tax-loss harvesting methodology takes advantage of investments with a decline in value by selling these investments. In the past 403b plans restricted their participants investment options primarily to variable annuities.

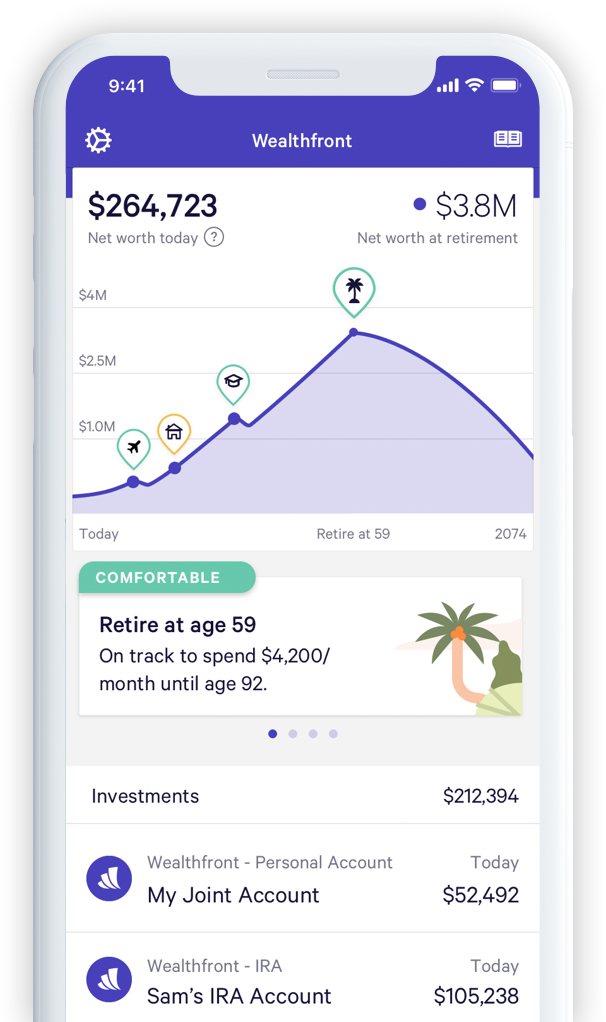

Wealthfront Best Overall Best Goal Planning. If you work in the same state as your employer your income tax situation probably wont change. Investing involves risk including the potential loss of principal.

As daunting as the concept may at first seem tax loss harvesting is not a difficult task. They face a tax rate similar to regular income. In fact these plans get their name from the section of the tax code concerning tax-sheltered annuities.

If you happen to be a Fidelity user Ive got a step-by-step guide for you as. Taxes on those gains top out at 20 but may be as little as 0. Betterment gives you the support and tools to make you a better investor.

Stocks and private equity available. Customize your portfolio based on risk savings goals and even values socially responsible investing. Including tax-loss harvesting which effectively covers the.

However if you hold onto assets for a year or more theyre long-capital gains. However the following are the most common working remotely tax implications to know about. When you start investing you dont set.

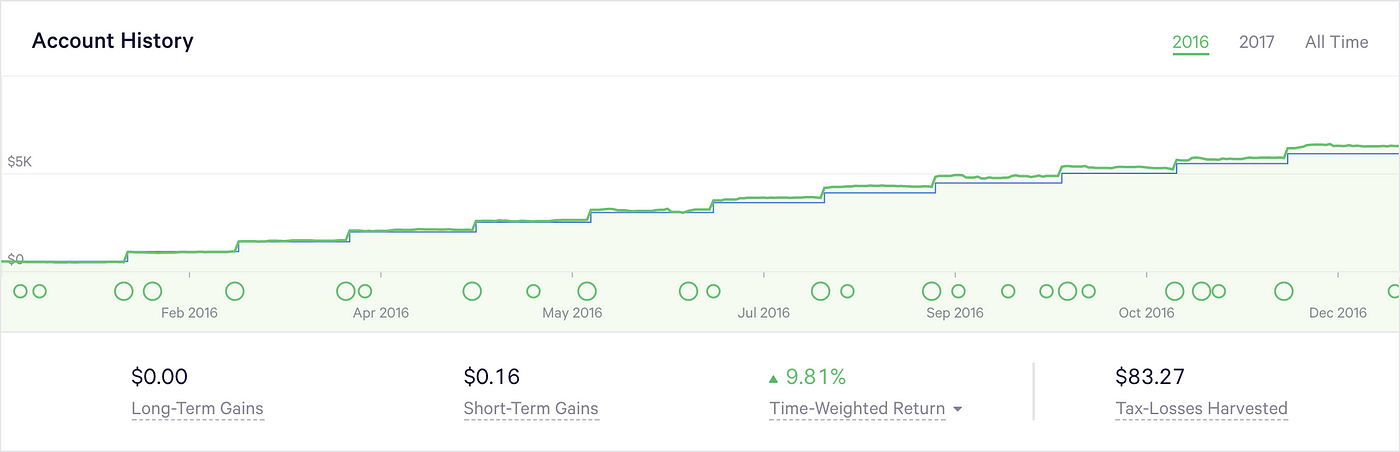

Meanwhile if you take a capital loss you can either deduct the loss this year or carry it over into a year when you make more. Additionally Wealthfront will recommend you employ tax-loss harvesting strategies to lower your potential tax bill when your taxable account reaches between 100000 and 500000. 2 days agoTax-Loss Harvesting.

This process minimizes taxes by selling losing investments to offset. Guide Tax Loss Harvesting Robo Advisors. If you decide to use this strategy known as tax loss harvesting its important to tread.

Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales.

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

Wealthfront Vs Unifimoney Choosing A Better Robo Advisor Unifimoney

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Wealthfront

Is Betterment Coming To The Uk And Eu Alternatives For 2022

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

The 5 Best Robo Advisors For Tax Loss Harvesting Moneymade

Wealthfront Vs Schwab Intelligent Portfolios Which Is The Best

Sigfig Vs Wealthfront Which Robo Advisor Is Best For You

Betterment And Wealthfront Are The Robos To Watch In The Battle Against Incumbents See How Their Strategies Stack Up Now And Robo Advisors Good Things Advisor

6 Reasons That Convinced Me To Invest With Wealthfront By Tai Zhang Medium

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

The Cryptocurrency Ico Sector Is Home To A Lot Of Innovative Ideas Bringing Those Ideas To Market Will Require Robo Advisors How To Raise Money Cryptocurrency

Get Everything Investment Management Including Advice Automated College Planning Financial Advice More From Investing Personal Finance Budgeting Money

Tax Loss Harvesting Is Overrated Frugal Professor

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance